Small-cap Companies Survey 2022

In 2022, we conducted our annual survey for the Small-cap companies in FTSE Nareit EPRA Index. Small-cap companies are defined as companies within the index that are not part of the top 60 based on market capitalization. The survey was developed around six key topics: target-setting, assessing transitional risk using CRREM, disclosure of energy/GHG data, GRESB participation, the formulation of asset level plans, and building certification. The questionnaires were individualized on the companies’ sustainability profiles and did not necessarily contain questions for all topics.

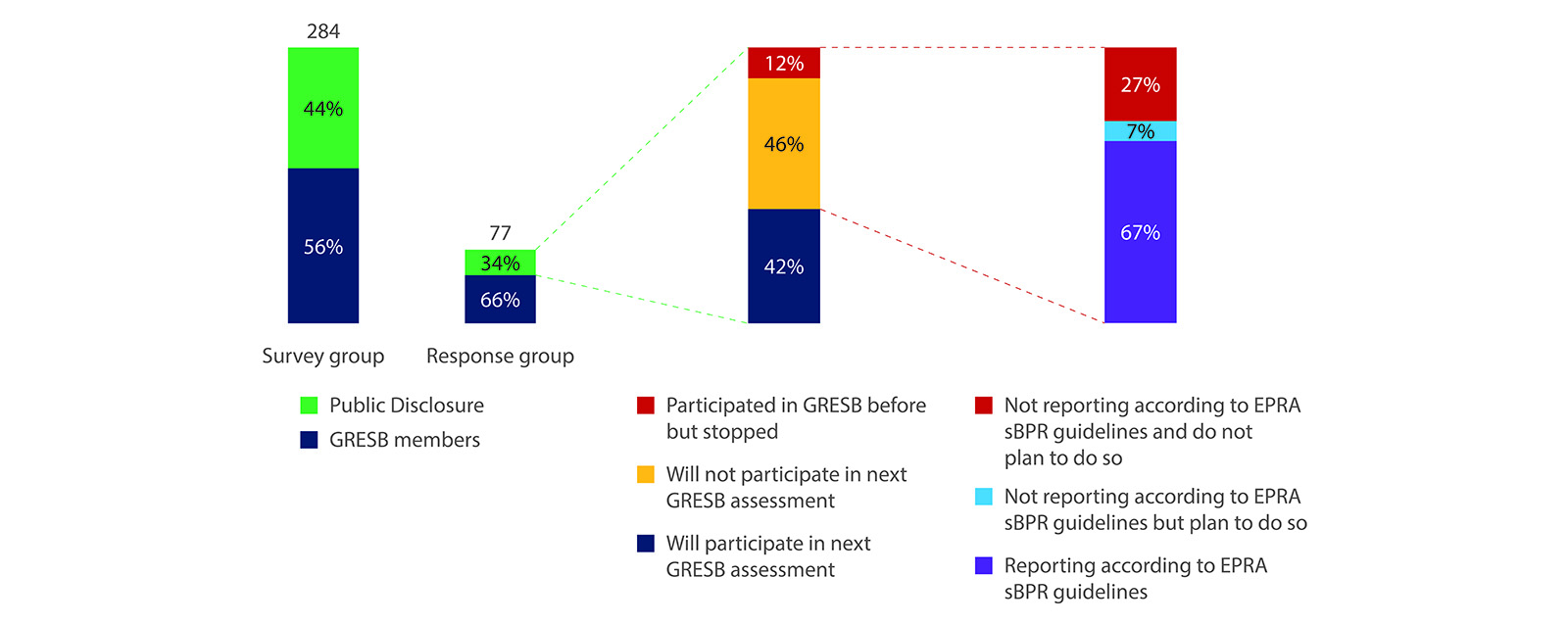

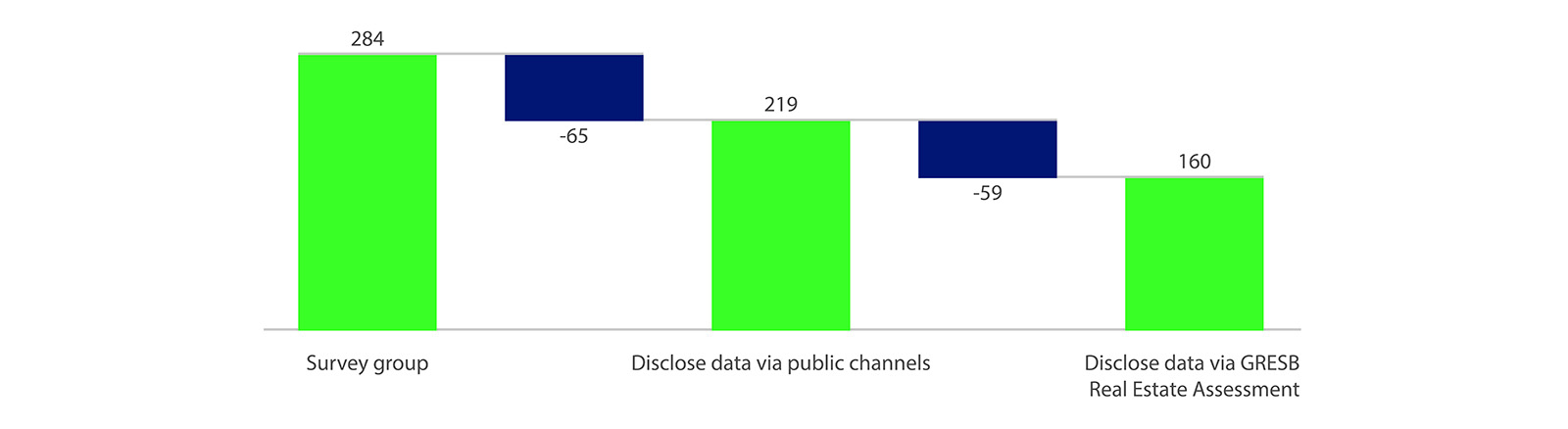

Figure 1 shows an overview of the Survey group and the Response group. 284 companies received our survey. 77 companies responded to the survey (Response group), resulting in a response rate of 27% (2021: 254, 38%). The survey results do not necessarily represent the whole group of small cap real estate companies but might suffer from biases.

GRESB participation is becoming the norm

It is noticeable that participation in GRESB is slowly rising. This year, 56% of all small cap companies in the Survey group are currently members of GRESB (2021: 52%). In the Response group, 66% are members of GRESB (2021: 57%). Those that are currently not GRESB members were asked about their plans to participate in GRESB in the near future. 42% of those are planning to join GRESB in the near future, while 12% participated before but stopped doing so. The remaining 46% are not planning to join GRESB, and of those 74% are reporting (or planning to do so) according to EPRA sBPR guidelines.

Figure 1: Survey group and Response group & GRESB participation

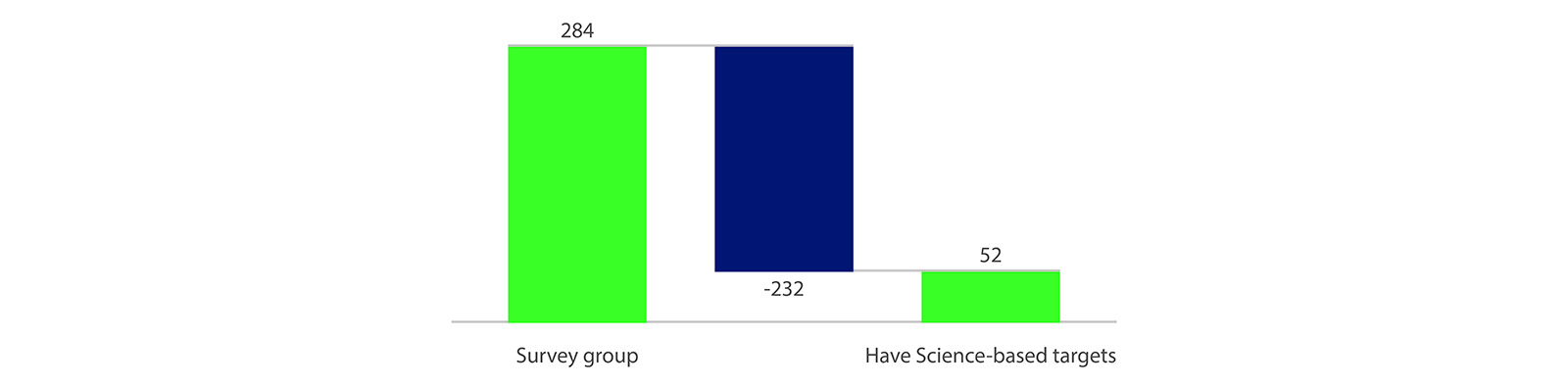

More small-cap companies have set Science-based targets

More small-cap companies in the index have set Science-based targets. Referring to Figure 2a, within the Survey group, 52 companies have set Science-based targets, equivalent to 18% (2021: 11%).

Figure 2a. Target-setting overview – Survey group

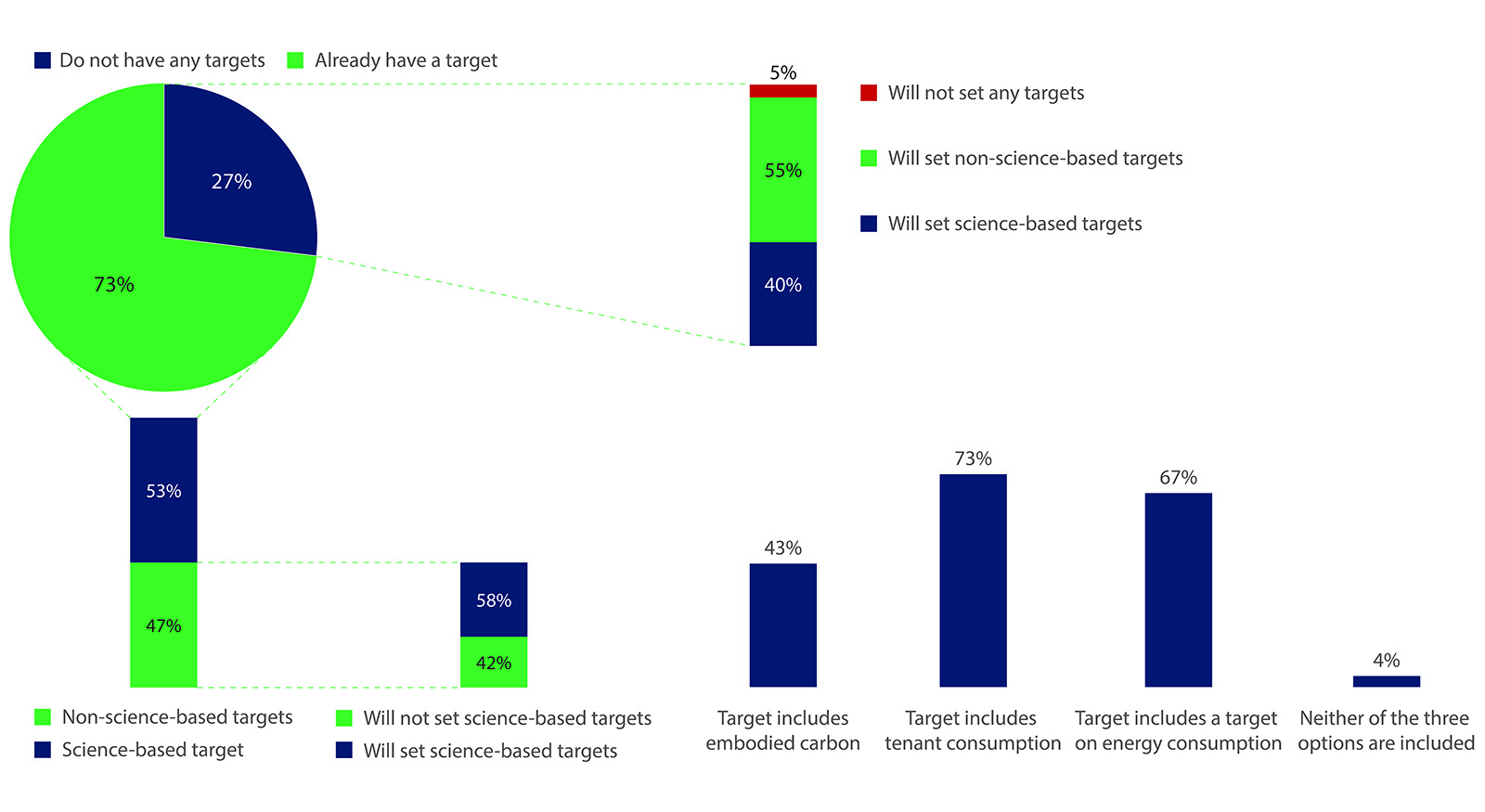

Referring to Figure 2b, within our survey, 73% of the Response group already has targets (2021: 58%) and 53% of this group already have science-based targets (2021: 32%). 58% of companies that already set targets which are not science based are intending to set science-based targets soon. 95% of the companies that have not set any targets are planning to set targets in the coming years.

Follow-up questions were asked to the companies who have already set or are planning to set science-based targets. These companies account for 69% of the Response group (63% in 2021). Scope 3 emissions (including tenant consumption and embodied carbon) was receiving more attention from companies. Out of all companies that have or will set Science-based targets, 43% include targets on embodied carbon, 73% include targets on tenant consumption, 67% include targets on energy consumption.*

There are also 22 companies that are not planning to set science-based targets. These companies have a variety of other target-setting standards such as internally-derived target standards, CRREM, WGBC, etc., and do not externally communicate their target.

Figure 2b. Target-setting overview – Response group

* Note: these statistics include both companies that have SBTi targets as well as companies that plan to have SBTi targets. For example, 19 companies mentioned their target includes embodied carbon. 12 of these 19 are companies that already have an SBTi target and state they have included embodied carbon (we checked this and they have in fact included embodied carbon) and 7 companies aim to set an SBTi target in the future and include embodied carbon.

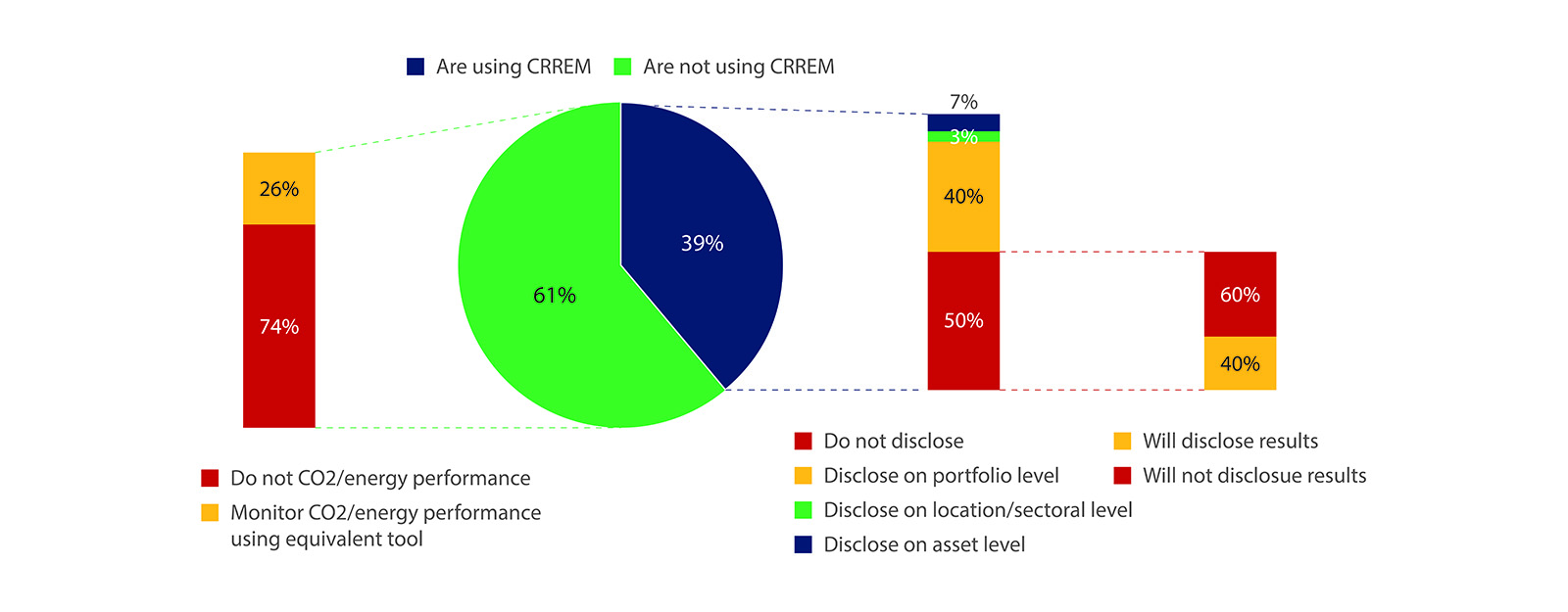

CRREM is slowly becoming the tool for transitional risk assessment

To further understand how companies are assessing the transition risks of their real estate portfolios, questions about Carbon Risk Real Estate Monitoring (CRREM) tool were asked.

Referring to Figure 3, overall, 39% of the response group is using CRREM (2021: 23%) and 50% of this group declared that they are disclosing mostly on portfolio-level but there is a low chance that they will disclose it on a more detailed level. 40% of those companies that are not disclosing CRREM result right now will disclose the results in the future, with differing levels of detail.

On the other hand, 61% of the response group are not using CRREM and three-quarters of this group are not monitoring their CO2 or energy performance against any equivalent tools. Surpisingly, 4 companies in this group actually have an SBTi target.

Figure 3. CRREM overview

Disclosing energy / GHG data is the market standard

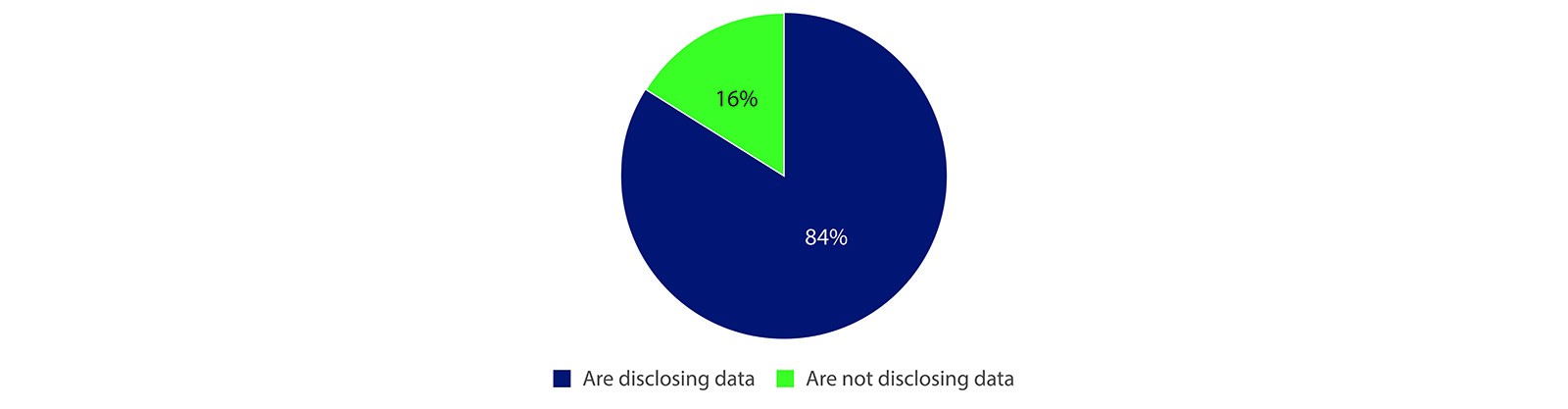

Referring to Figure 2a, 219 companies disclosed energy / GHG data, representing 77% of companies in our survey group. The majority of companies who disclosed performance data are GRESB members (160 out of 219 companies). Referring to Figure 4b, 84% of the response group do disclose this data (71% in 2021). The remaining 16% of the group is made up of only companies that are not members of GRESB but are part of the Public Disclosure assessment, as GRESB members are obligated to report performance data. All these non-disclosing companies, via our survey, stated that they will disclose performance data in the coming year.

Figure 4a. Data disclosure – Survey group

Figure 4b. Data disclosure – Response group

Companies acknowledged that asset-level plan formulation is the next step

27 companies declared in 2021 that they were formulating asset-level plans. Of these 27, six companies are within this year’s Response group. In this year’s survey, we asked these companies if they can share some examples of their formulated asset-level plans. However, five of those companies were not willing to do so. We have followed up with the company that is willing to share their plans.

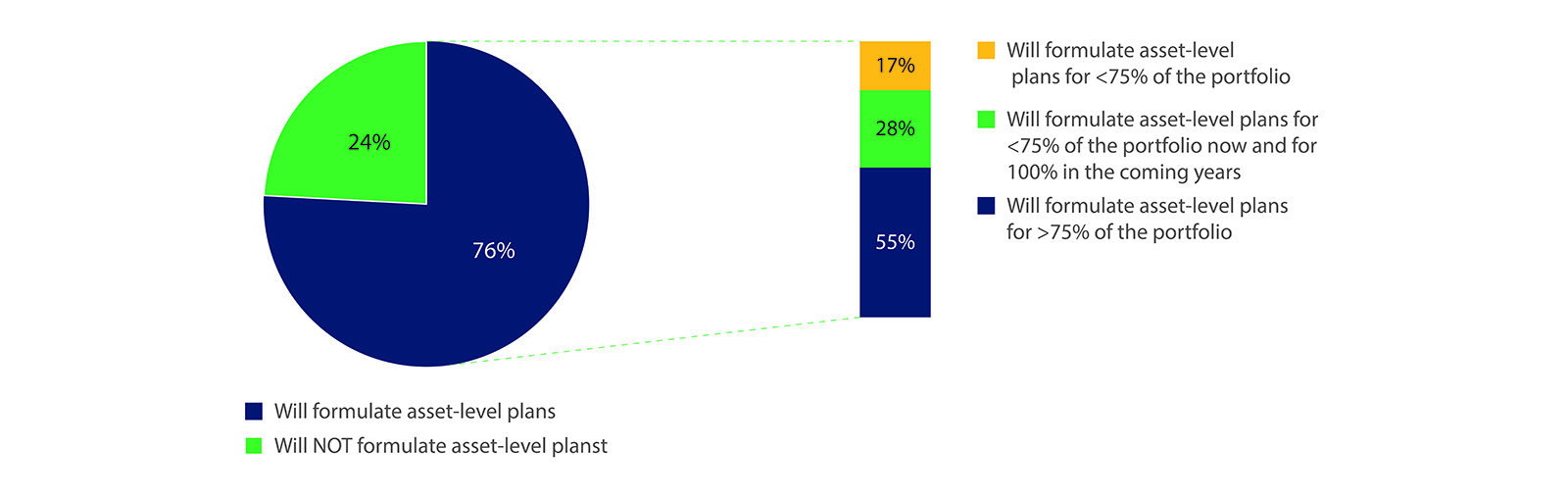

Referring to Figure 5, of the 71 companies in the Response group, 76% stated that they will formulate asset-level plans in the coming years. The majority of this group (55%) aimed to formulate asset-level plans (>75% of the total portfolio) in the coming years.

Figure 5. Asset-level sustainability plans

Building certification is common but the portfolio coverage is still low

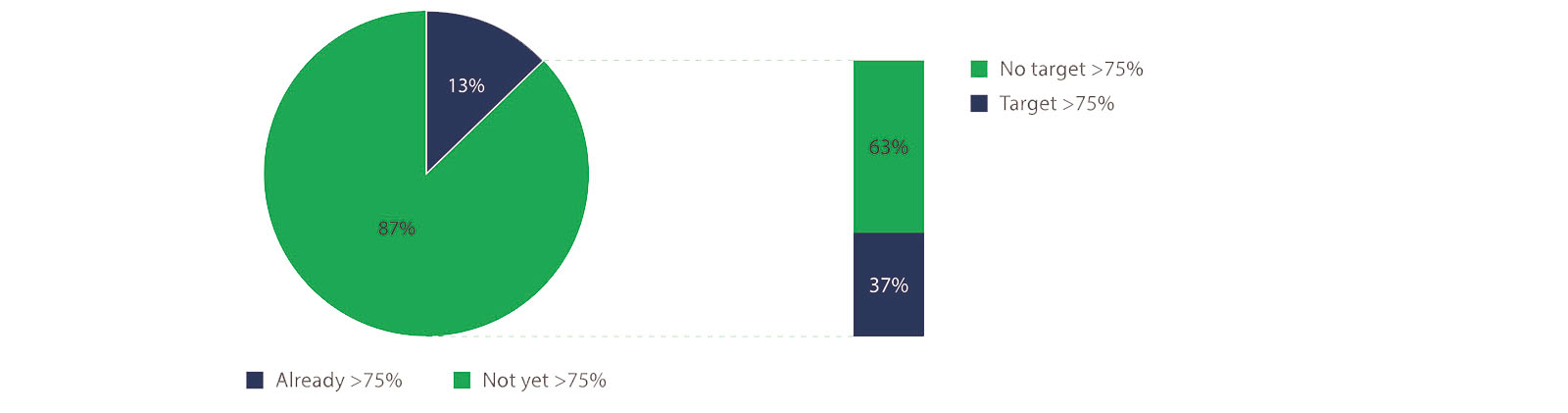

Referring to Figure 6, approximately 87% of the companies in the Response group do not have building certificates for more than 75% of the assets in their portfolio. 37% of this group aimed to grow the coverage of building certification to more than 75% of their portfolio (2021: 30%).

Figure 6. Building certification

Call upon investors to collaborate to achieve real-world impact

GREEN network members acknowledge the importance of collaboration to initiate change and maximize impact. We therefore call upon other institutional investors to join GREEN and work together towards a Paris-aligned real estate sector. Check the Investor statement for more information.